You’re pre-approved!

Sign up now to receive your new credit card!

Every day when you open your mailbox, you find at least one credit card solicitation.

Credit card companies are notorious for being overly aggressive, targeting college students, and taking advantage of people who do not understand the dangers of debt.

If you want to stop receiving junk mail, there is an option that puts you on the do not mail list for credit card companies and banks.

The OptOutPreScreen.com website, a joint venture between the major credit bureaus allows you to tell them that you don’t want their junk mail. Signing up once covers all three bureaus.

In this article, we will discuss whether OptOutPreScreen.com is legit.

Do Prescreened offers affect your credit score?

One concern is that all these companies that have “pre-approved” you must have pulled your credit score, right?

A “hard inquiry” is when a company pulls your credit score to analyze whether or not you are able to repay the debt.

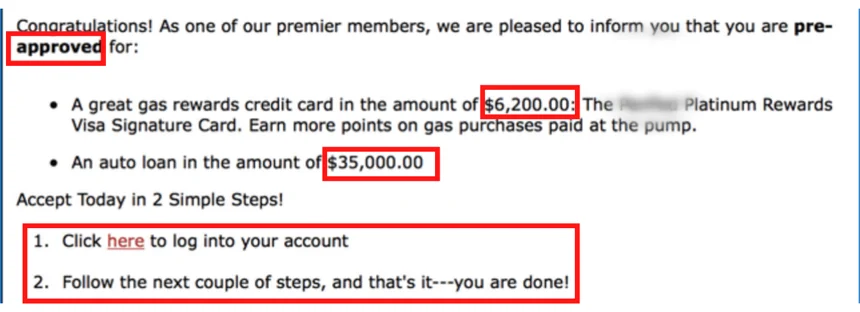

The term “pre-approved” has been under scrutiny as of late.

Credit Karma was recently fined $3 million by the FTC for pushing the “you’re pre-approved” message throughout its marketing campaign.

This message excites the majority of people in need of some extra money and increases the chances of them filling out the form.

A closer look at the form will notify you that you are not pre-approved. You have to fill out a form and submit it with the chance of being pre-approved.

Pre-approved offers inquiries do not affect credit scores unless you apply for credit. Before being approved for credit, anyone who accepts an offer must still fill out an application.

How to Opt-Out of Pre-Approved Offers

Federal law allows you to opt out for up to five years if you do not wish to be pre-approved for credit card offers.

In order to opt-out, you can visit www.optoutprescreen.com. You can also call toll-free 888-5-OPT-OUT (888-567-8688).

You also have the ability to opt-out of insurance offers.

The Fair Credit Reporting Act (FCRA) allows the Consumer Credit Reporting Companies to include your name in lists used by creditors and insurers to make firm credit or insurance offers that are not initiated directly by you.

The FCRA also allows you to opt-out, which will block your name from being released to companies who want to solicit their offers.

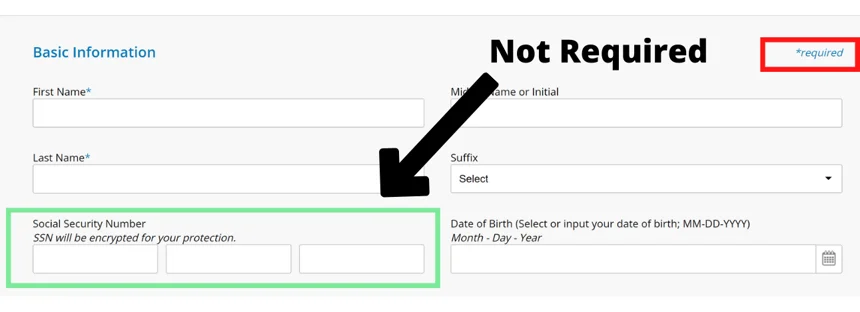

In order to complete the process, OptOutPreScreen.com requires you to provide the following information:

- Name

- Address

- Social Security Number

- Date of Birth

If your privacy alarm bell is ringing, you are not alone…

Is it safe to give your social security number to opt out?

OptOutPreScreen.com Social Security Number

You do not need to provide your social security number to OptOutPrescreen.com in order to complete the process.

However, the website recommends providing your SSN in order to ensure “accuracy” and to ensure that the process works correctly.

Is OptOutPreScreen.com legit?

Experian, Equifax, TransUnion, and Innovis run the OptOutPrescreen.com website and line. These are four major credit bureaus for consumers.

It is the only website that is authorized by the nationwide credit bureaus.

According to the official website, OptOutPrescreen.com will never reach out to customers so any calls claiming to be from them are false.

Protecting Your Online Privacy

The solicitation of the credit card offers is just the tip of the iceberg.

Data brokers display personal information to the public including your name, address, phone number, and more.

If you are freely filling out credit offers, sensitive information such as bank records, security questions, and your social security number can end up on the dark web.

We are always waiting for the next data breach to happen. Why not be proactive?

NewReputation allows you to take control of your online privacy and remove unwanted information from the internet.

Receive your free proposal and see how we can protect your reputation today!

The NewReputation Help Center discusses brand reputation, online PR, search engine marketing, content marketing, and much more.